Black_Kira

Cathie Wood and Ark Invest are optimistic about the future of artificial intelligence. The high profile, innovation-focused investor highlighted the importance of AI and the convergence of technology platforms in a “Big Ideas 2023” investor report.

Wood and his team pointed out that market participants should consider five converging innovation platforms capable of “defining this technological era”. At the center is artificial intelligence, with robotics, multiomics sequencing, public blockchains and nearby orbiting energy storage.

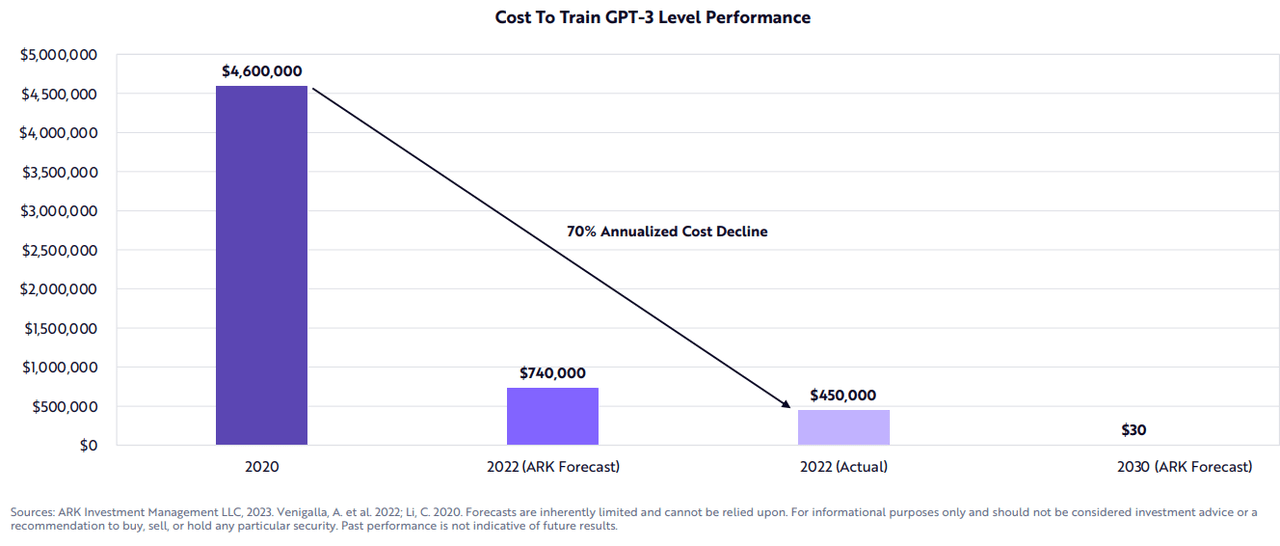

ARK believes that these technologies can together provide exponential growth in the future of the global economy. The company claimed AI training cost reductions are continuing at an annual rate of 70%. To put that into perspective, the cost of training a large language model at GPT-3 level performance has dropped to $450,000 in 2022 from close to $4.6 million in 2020, ARK noted.

“We expect the cost decline to continue at a rate of 70% through 2030.” See a chart below of the predicted drop in the cost of AI, according to ARK.

Wood said: “We’ve been working on artificial intelligence for a long time now, and I think some of the things we’re seeing are just the beginning of the impact that artificial intelligence is going to have on every sector, every industry, and each business.

Wood’s 2023 Big Ideas Report adds, “The market value of disruptive innovation platforms could grow 40% at an annual rate over this economic cycle, from $13 trillion today to $200 billion.” trillion dollars by 2030. In 2030, the market value associated with disruptive innovation could account for the majority of global market capitalization.

Although Wood did not offer specific stock picks, potential AI stocks include names like C3.ai (AI), as well as companies providing the technological backbone for advances in the space, like Nvidia (NVDA) and Ambarella (AMBA).

Meanwhile, many big names in tech are also deeply entrenched in AI. This includes Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Apple (AAPL) and IBM (IBM).

Other big ideas for 2023 that Wood and his team are focusing on include digital consumers, digital wallets, Bitcoin (BTC-USD), smart contract networks, precision therapies, electric vehicles, hail autonomous and orbital aerospace.

Here are Wood’s actively managed ETFs:

- ARK Innovation ETF (NYSEARCA:ARKK)

- ARK Next Generation Internet ETF (NYSEARCA:ARKW)

- ARK Autonomous and Robotic Technology ETF (BATS: ARKQ)

- ARK Genomic Revolution ETF (BAT:ARKG)

- ARK Fintech Innovation ETF (ARKF)

- ARK Space Exploration and Innovation ETF (ARKX)

In other AI-related news, see the AI-based exchange-traded fund that doubled S&P 500 returns in January.