thinkhubstudio

Investment thesis

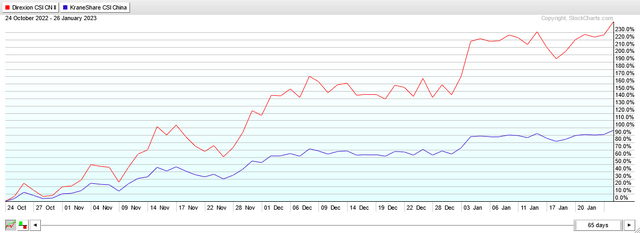

KWEB and CWEB returned 96.36% and 245.09% in 65 trading days between 10/24/2022 and 01/26/2023. The graph below shows that these terrific returns were achieved without any significant selling.

I expect this recovery to be persistent and may continue, intermittently, with modest corrections for at least six months. Therefore, I rate both funds as BUY. The choice between KWEB and CWEB mainly depends on the risk tolerance of the investor, those with low risk tolerance should invest in the non-leveraged fund, KWEB, while the more aggressive can opt for CWEB. Everyone is expected to use strong risk management strategies as these funds are highly volatile.

stockcharts.com

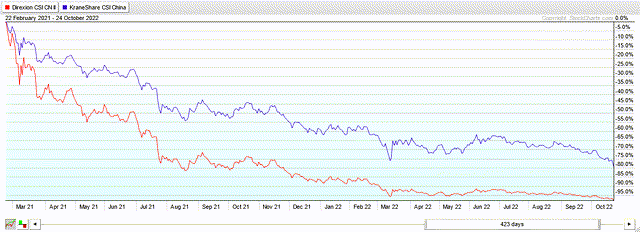

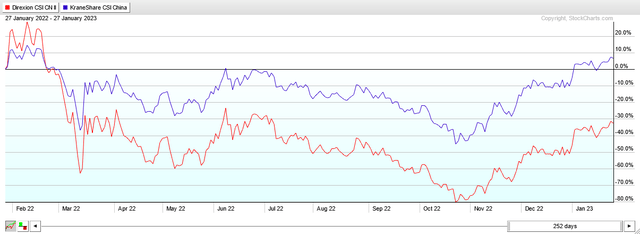

To appreciate the risks involved, we can look at the following graph, showing a very long downtrend of almost two years, from 02/22/2021 to 10/24/2022. During this interval KWEB and CWEB reported -79.33% and -97.78%, respectively. To recover from these devastating losses, KWEB would need a gain of 484%, while CWEB needs 4,504%.

stockcharts.com

Although huge, these figures should not scare off investors familiar with the workings of the markets. On the contrary, we all read the mantra that “leverage” is dangerous and leveraged funds are just day trading instruments, suitable only for hedge fund specialists and professional traders. It is a myth that is demolished by a simple argument.

Both charts show that the consistency and strength of the trends presented exceptional opportunities for long-term trading. A CWEB long trade initiated on 10/24/2022 would have gained 245%. This is more than double the 96% efficiency of KWEB. This is a great example that in regular uptrends, leveraged funds generate incremental gains, above the leverage factor.

A similar argument can be made for downtrends, but I won’t dwell on it, since this article is aimed at long-only investors. Hedge fund specialists know very well how to profit by shorting the markets.

KWEB fund data

Creation date: 07/31/2013

Net assets: 6.5 billion

Yield: 0.44%

Expense ratio: 0.69%

Top 10 holdings as of 2023-1-25

Tencent Holdings Ltd 10.88%

Alibaba Group Holding Ltd Ordinary Shares 9.75%

Meituan Class B 7.23%

JD.com Inc Common Stock – Class A 5.98%

Pinduoduo Inc ADR 5.80%

NetEase Inc common stock 4.43%

Tencent Music Entertainment Group ADR 4.09%

Kanzhun Ltd ADR 4.00%

Trip.com Group Ltd 3.96%

KE Holdings Inc ADR 3.93%

Number of titles 34 at 2023-01-25

KWEB Valuation

All KWEB shares have low valuations. The weighted average of book price, sales and cash flow is significantly lower than similar US stocks.

Price/Pound = 4.29

Price/Sales = 0.55

Price/cash flow = 23.65

Technical analysis

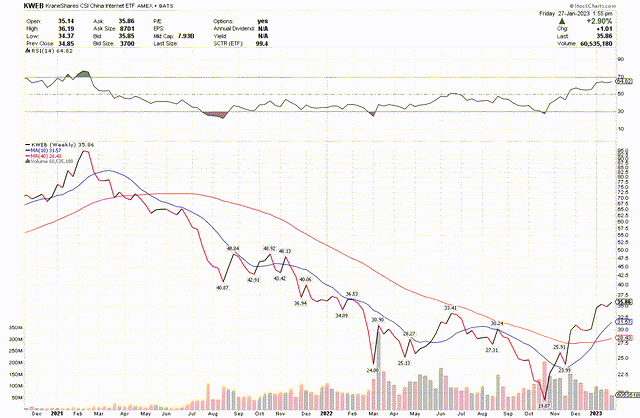

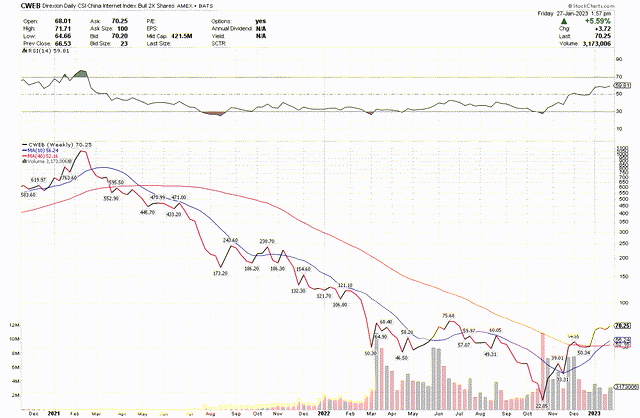

The weekly price charts of KWEB and CWEB are identical twins. The high was in February 2021 and the low was in October 2022.

The KWEB chart shows a “bullish” crossover of the 10-week MA with the 40-week MA during the last week of December. The same pattern happened about two weeks later on CWEB.

Both charts indicate a strong uptrend, which I believe should continue.

stockcharts.com

stockcharts.com

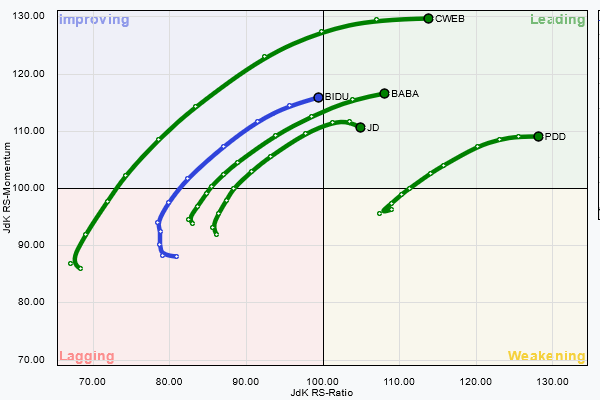

Next comes a “relative rotation graph” of KWEB, CWEB and TCEHY, BIDU. This illustrates that the outperformance of Chinese Internet stocks is in full swing and has strong momentum.

stockcharts.com

Both funds have options. KWEB has LEAP options in two years, until January 2025. The CWEB options market is very limited with the longest expiration in six months, by July 2023.

Cautionary Notes

These notes discuss the additional risks associated with trading leveraged assets, such as CWEB.

First, here is a statement from FINRA on Inverse and Leveraged Funds Trading.

“Due to compounding effects, their performance over longer periods may differ significantly from their stated daily target. Therefore, leveraged and inverse ETFs that reset daily are generally not suitable for retail investors who plan to hold them for more than one trading session, especially in volatile markets.”

Regulatory Notice 09-31 | FINRA.org

The following chart illustrates the value erosion experienced when a leveraged fund is held for a long period of time. While KWEB has returned 6.54% over the past twelve months, the 2X Leveraged Fund CWEB has returned -32.57%, a significant loss.

stockcharts.com

Conclusion

The odds for CWEB and KWEB are BUY.

Both funds are highly volatile and require strong risk protection measures.

As a leveraged fund, CWEB is NOT suitable as a long term investment and is recommended as a BUY only for short term tactical investment. Long-term investors should use the KWEB fund without leverage.

Editor’s Note: This article discusses one or more securities that do not trade on a major US exchange. Please be aware of the risks associated with these actions.